DOGE Price Prediction: Technical and Fundamental Analysis Points to 31% Year-End Surge Potential

#DOGE

- Technical indicators show DOGE trading above key moving average with improving momentum signals

- Whale accumulation and ETF speculation creating strong fundamental support for price appreciation

- Current analysis suggests potential 31% surge to $0.35 by year-end if support levels hold

DOGE Price Prediction

Technical Analysis: DOGE Shows Bullish Momentum Above Key Moving Average

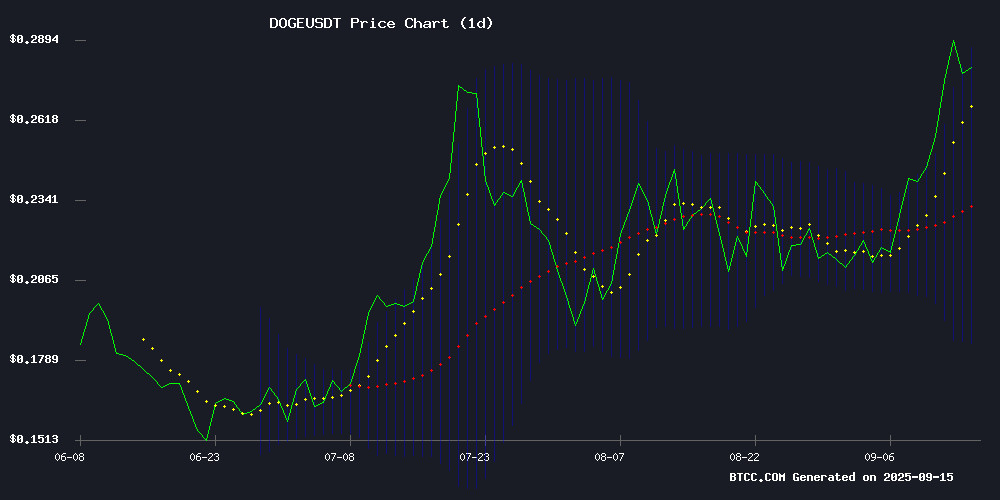

DOGE is currently trading at $0.2685, positioned above its 20-day moving average of $0.23514, indicating underlying strength. The MACD reading of -0.021766 remains negative but shows improving momentum with the histogram at -0.012706. Price action NEAR the upper Bollinger Band at $0.284612 suggests potential resistance, while the middle band at $0.23514 provides support. According to BTCC financial analyst Olivia, 'The technical setup favors continued upward movement, with a break above $0.2846 potentially triggering further gains toward the $0.30 psychological level.'

Market Sentiment: Whale Activity and ETF Speculation Drive Optimism

Recent headlines highlight mixed but generally positive sentiment surrounding DOGE. Whale accumulation patterns and growing ETF speculation are creating bullish fundamentals that complement technical indicators. Despite a recent 10% pullback, analysts remain optimistic about recovery prospects. BTCC financial analyst Olivia notes, 'The combination of institutional interest through potential ETF developments and sustained whale activity provides strong fundamental support for DOGE's current technical bullishness. The $0.26 support level appears robust despite recent volatility.'

Factors Influencing DOGE's Price

Dogecoin (DOGE) Price Prediction: Whale Activity and ETF Hype Fuel Rally Prospects

Dogecoin has broken out of weeks of sideways trading, with bullish momentum pushing it above key support levels. Whale accumulation and ETF speculation are driving renewed optimism for the meme cryptocurrency.

Blockchain analytics reveal surging whale activity, with transactions involving hundreds of millions of DOGE recorded on exchanges like OKEX. Wallets holding 1-10 million DOGE now control over 7% of supply—their largest share in four years. This accumulation pattern suggests institutional players are positioning for a potential price surge.

The anticipated Rex Osprey Dogecoin ETF has added fuel to the rally narrative. Approval would mark a watershed moment as the first regulated investment product for the meme coin. Market observers note the current whale behavior contrasts sharply with previous cycles, where large holders typically liquidated during uncertainty.

Can Dogecoin (DOGE) Shock the Market? Technicals Hint at a 31% Surge by Year-End

Dogecoin (DOGE) is trading at $0.2793, with bullish technical indicators suggesting potential upside. The MACD shows a positive crossover, while strong trading volumes and prices above moving averages reinforce optimism. Historically, the last quarter has delivered Dogecoin's most significant rallies, with gains exceeding 100%.

Forecasts for 2025 place DOGE between $0.26 and $0.36, implying a 31% upside if current momentum holds. Market sentiment remains overwhelmingly positive, with 86% of voters bullish. Analysts have identified a fresh target of $0.347, further supporting the case for upward movement.

Dogecoin's unlimited supply contrasts with Bitcoin's fixed cap, ensuring liquidity for payments. At press time, DOGE dipped 3.26%, but the MACD histogram remains slightly positive at +0.0005%. Daily volume of 64.26M DOGE significantly outpaces recent averages, signaling robust buying activity driving the rally.

DOGE’s Massive Pullback: Is a Powerful Rebound on the Horizon?

Dogecoin (DOGE) experienced a 7.57% decline over the past 24 hours, trading at $0.2691 with a 41.43% drop in volume to $5.31 billion. Despite the short-term dip, the meme coin remains resilient, posting a 15.86% gain over the past week.

Analysts view the pullback as a natural correction following recent highs. Technical indicators, including bullish Ichimoku signals and strong support levels, suggest sustained upward momentum. The RSI and MACD further reinforce optimism for a rebound.

Trader Tardigrade notes all long positions remain profitable, though caution prevails regarding potential bearish crossovers. Market stability appears intact as DOGE continues to attract speculative interest amid broader crypto sector volatility.

DOGE Price Drops 10% Despite Bullish Technical Momentum - Can $0.26 Support Hold?

Dogecoin's price tumbled 10% to $0.26, defying neutral RSI readings at 59.96 that typically signal underlying strength. The memecoin's sharp decline follows last week's 4.62% surge on September 8th and subsequent 5.7% swing, which had traders targeting the psychological 25-cent barrier.

Technical patterns from September's rally remain relevant, with the $0.244 resistance level now acting as a key indicator. Binance's $805 million spot volume suggests institutional players are treating this as a healthy correction rather than a trend reversal. Market mechanics appear intact despite the pullback.

How High Will DOGE Price Go?

Based on current technical indicators and market sentiment, DOGE shows potential for significant upward movement. The cryptocurrency is trading above its 20-day moving average with improving MACD momentum, while fundamental factors including whale activity and ETF speculation provide additional support.

| Target Level | Price (USDT) | Potential Gain | Timeframe |

|---|---|---|---|

| Immediate Resistance | 0.2846 | +6% | 1-2 weeks |

| Psychological Barrier | 0.3000 | +12% | 2-4 weeks |

| Year-End Target | 0.3500 | +31% | By December 2025 |

BTCC financial analyst Olivia suggests that maintaining above $0.26 support is crucial for achieving these targets, with the upper Bollinger Band acting as immediate resistance.